**XRP Slides 6% as Bearish Bitcoin Sentiment Weighs Down Ripple-Linked Token**

*Updated Nov 5, 2025, 3:19 a.m. | Published Nov 5, 2025, 3:17 a.m.*

—

**What to Know:**

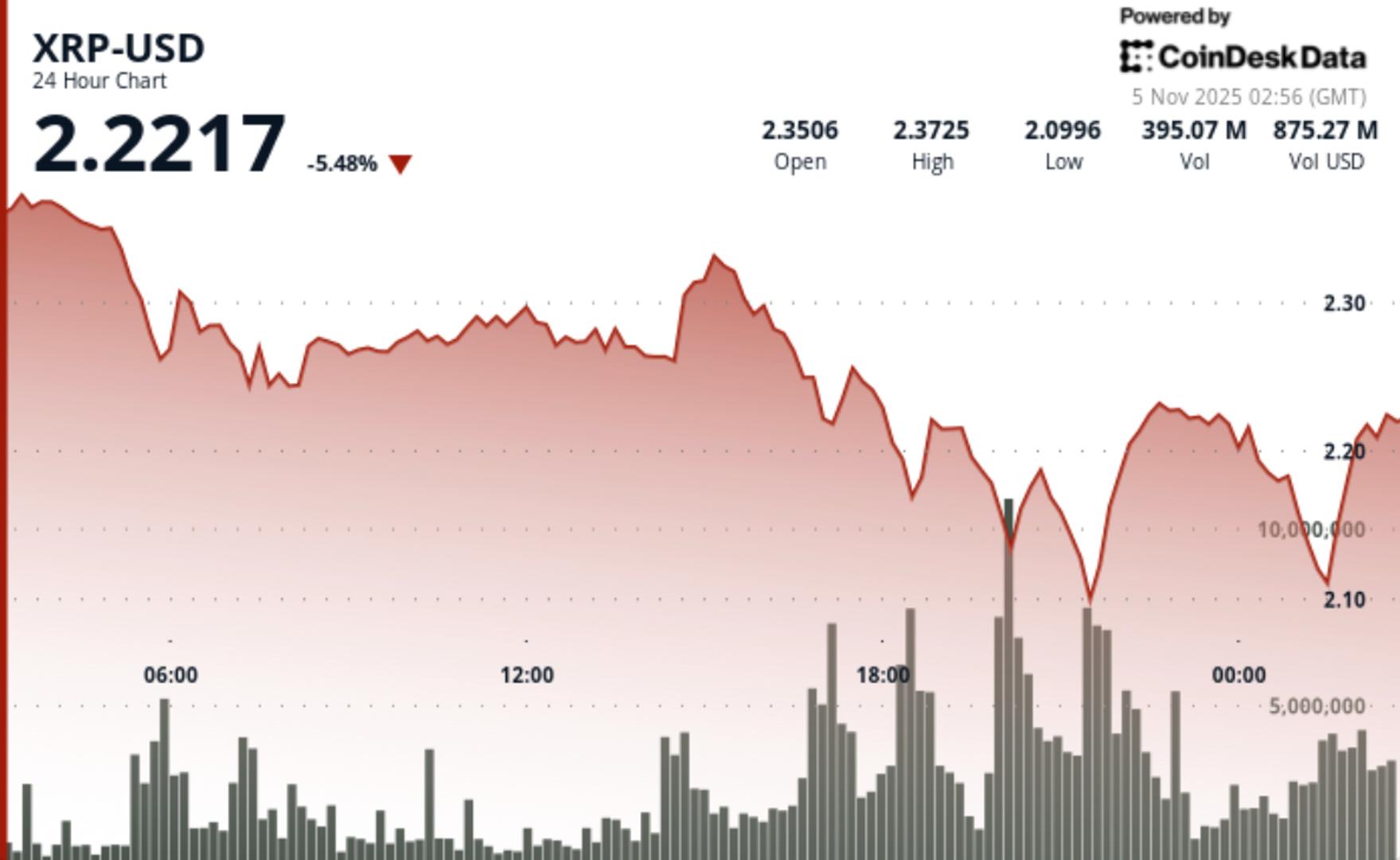

XRP fell 6.4% to $2.20 amid heavy institutional selling, breaking key support levels. Trading volume surged 126% above average, indicating strong institutional participation in the selloff. Traders are closely monitoring the $2.08 support level to prevent further declines toward the $2.00 psychological zone.

—

### Price Action Overview

XRP plunged sharply during Tuesday’s session, breaking below important support levels on exceptional volume as bearish momentum intensified. The token briefly recovered from a session low of $2.08, stabilizing around $2.20, but remained under pressure.

Over the past 24 hours, XRP slid from an intraday high of $2.35 down to $2.20, trading within a wide 12.4% range. This movement occurred even as the broader crypto market showed signs of stabilization, emphasizing XRP’s isolated weakness.

—

### Trading Volume and Institutional Pressure

Trading volume surged to 356.7 million tokens traded, marking a 126% increase above the 24-hour average. This spike highlights significant institutional involvement in the selloff.

Strong resistance continued to hold at $2.37, with rebound attempts toward $2.33 and $2.23 repeatedly rejected. The inability to sustain gains above these prior support levels suggests a shift from accumulation to active distribution by sellers.

—

### Intraday Price Details

After breaking below $2.17, XRP’s price dropped to a session low near $2.08 before showing signs of recovery. It climbed approximately 4.5% from a $2.11 base up to $2.209 during a short-term volume burst of 5.8 million tokens. However, the rally stalled at around $2.216 as liquidity dried up.

This late-session bounce coincided with news that Ripple’s RLUSD stablecoin surpassed $1 billion in market capitalization. Despite this positive fundamental update, technical dynamics remained the dominant force driving price action.

—

### Technical Analysis

XRP’s price pattern formed consecutive lower highs and lower lows starting from the $2.37 resistance peak, confirming a short-term downtrend.

Volume behavior further validates this bearish bias, with increased volume during selloffs and contraction during recovery attempts—a classic indicator of institutional distribution.

Momentum indicators, including the Relative Strength Index (RSI), have turned negative after dropping from overbought levels earlier in the month and now hover near neutral territory.

The failure to reclaim the $2.17 support-turned-resistance level points to possible further downside unless fresh demand emerges near the $2.08 – $2.11 consolidation range.

While XRP’s structure hints at a potential oversold recovery, volume divergence and repeated failed retests imply that rallies may continue to encounter heavy resistance until broader market sentiment improves.

—

### What Traders Should Watch

– **Support Levels:** Traders are watching closely to see if XRP can hold above the $2.08 support. Failure to do so could accelerate losses toward the key psychological level of $2.00.

– **Resistance Levels:** A sustained move above $2.22 would be necessary to regain bullish momentum.

– **Key Price Zone:** For tactical traders, the $2.17 to $2.22 price range is a critical inflection point that may define short-term direction.

– **Volume Insights:** Institutional volume spikes during declines confirm active repositioning rather than retail-driven volatility, signaling caution for market participants.

—

### More For You

**Inside Zcash: Encrypted Money at Planetary Scale**

*By CoinDesk Research | Nov 3, 2025*

In 2025, Zcash has evolved from niche privacy technology into a fully functioning encrypted-money network. Shielded adoption surged dramatically, with 20-25% of circulating ZEC now held in encrypted addresses, and 30% of transactions involving the shielded pool.

The newly launched Zashi wallet has made shielded transfers the default, moving privacy from an optional feature to the standard. Furthermore, Project Tachyon, led by Sean Bowe, aims to increase throughput to thousands of private transactions per second.

Zcash has surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by market capitalization.

—

*Stay tuned for further updates on XRP and other cryptocurrencies as market dynamics continue to evolve.*

https://www.coindesk.com/markets/2025/11/05/xrp-slides-6-as-bearish-bitcoin-sentiment-weighs-down-ripple-linked-token