Understanding Solar Incentives

Solar incentives are designed to promote the use of renewable energy sources, particularly solar power, by providing financial benefits and support to homeowners. These incentives can take many forms, such as tax credits, rebates, or grants that reduce the upfront cost of installing solar panels. Understanding these incentives is crucial for homeowners who want to take advantage of the potential savings and environmental benefits associated with solar energy.

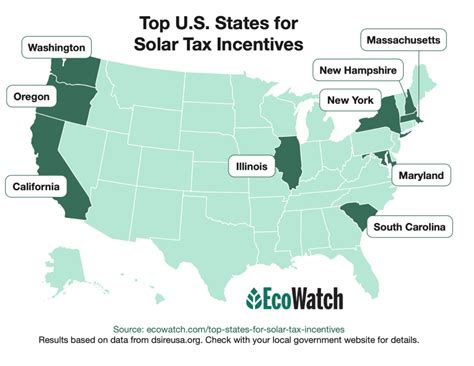

Several programs aim to make solar energy more accessible and appealing. For instance, many states offer solar energy system tax credits, which can significantly lower installation costs. Additionally, programs like the Oregon Solar Savings Rebate Program provide further financial assistance to homeowners considering solar.

“Investing in solar not only reduces utility bills but also contributes positively to the environment,” suggests an industry expert.

Homeowners should also consider local and federal incentives available in their area to maximize their benefits from solar initiatives. A comprehensive approach includes researching available programs and how they fit into personal financial goals. Some tips for getting started include evaluating energy needs and understanding how different incentives work together for optimal savings.

Benefits of Solar Incentives

Homeowners can gain significant advantages from solar incentives, leading to both economic and environmental benefits. Primarily, financial savings are realized through reduced utility bills and potential tax credits that make solar installations more affordable. Many local and state governments offer various programs, which can further enhance these savings. Besides the direct financial implications, utilizing solar energy contributes positively to the environment by decreasing reliance on fossil fuels and reducing greenhouse gas emissions. Additionally, this shift towards renewable energy can lead to increased home value, as properties equipped with solar systems are often more attractive to buyers. Homeowners seeking specific programs tailored to their needs can refer to resources such as Energy Trust’s solar electric incentive lookupor explore opportunities from the Maryland Solar Task Forcefor further guidance on available incentives.

Financial Savings from Solar Energy

Homeowners can experience significant financial savings by investing in solar energy systems. Utilizing solar panels not only reduces monthly electricity bills but can also lead to long-term financial benefits through various incentive programs. Many regions offer tax credits, rebates, and other financing options that help offset the initial installation costs. For instance, programs like NY-Sunin New York and Austin Energy’s solar solutions for homes Austin Energycan offer homeowners substantial reductions in upfront expenses. Additionally, as energy prices rise, solar energy not only shields homeowners from these costs but also provides price predictability since sunlight is free. By effectively leveraging these savings and incentives, homeowners can make a sustainable choice that directly impacts their financial well-being while contributing to environmental goals.

Environmental Impact of Solar Programs

The implementation of solar programs significantly contributes to reducing carbon emissions and promoting a cleaner environment. By harnessing solar energy, homeowners can limit their dependence on fossil fuels, which are a major source of air pollution and greenhouse gases. This transition to renewable energy helps mitigate climate change, fostering a sustainable future. Moreover, programs supporting solar energy adoption often include incentives that encourage installation of solar panels, thus increasing community engagement in renewable practices. Homeowners can take advantage of such initiatives not only for their personal benefit but also for the collective good. For more details on available federal incentives, check out the Residential Clean Energy Creditor explore local options at Massachusetts Solar Information Programs.

Available Solar Programs for Homeowners

Homeowners have access to a variety of solar programs designed to make the transition to renewable energy more cost-effective and accessible. These initiatives include state and federal tax credits, grants, and rebates for solar installation. For instance, the Federal Investment Tax Credit allows homeowners to deduct a significant percentage of their solar installation costs from their federal taxes. Various states also provide additional incentives such as cash rebates or low-interest loans to further lessen upfront expenses.

In addition, utilities often offer net metering programs, enabling homeowners to sell excess energy back to the grid, thus offsetting their electricity bills. It’s beneficial for homeowners to research local offerings, as programs can vary widely by state and region. Resources like Solar Incentives New Jerseyand Solar Washingtonprovide detailed insights into available incentives tailored to specific areas, helping homeowners make informed decisions about maximizing their solar investments.

Boosting Home Value with Solar

Investing in solar energy not only contributes to a sustainable environment but also significantly enhances property value. Homebuyers increasingly prioritize energy-efficient homes, and having solar panels installed can make a property more attractive in today’s market. According to recent studies, homes equipped with solar energy systems can sell for a premium over similar properties without them. This increase in value comes partly from the expected utility savings and the long-term benefits that solar systems provide. Additionally, homes with solar installations often experience lower energy costs, which prospective buyers view as a financial advantage. As the demand for renewable energy solutions rises, homeowners who embrace solar incentives can unlock both immediate savings and increased home equity.

Choosing the Right Solar Option

Selecting the appropriate solar option for your home is crucial to optimizing the benefits from available incentives. Homeowners should consider their energy needs, roof size, and orientation when choosing a solar system. Additionally, evaluating the types of solar panels—such as monocrystalline or polycrystalline—can influence both installation costs and energy efficiency. Connecting with local solar providers can provide insights into which options best suit individual circumstances, while also ensuring compliance with regional incentive programs. Furthermore, assessing financing options, including solar loans or leasing arrangements, can help homeowners maximize financial benefits while minimizing upfront costs. Transitioning to solar energy is a significant investment; hence, thorough research and consultation are key to making informed decisions that align with both personal goals and environmental objectives.

How to Get Started with Incentives

To begin taking advantage of solar incentives, homeowners should first research the specific programs available in their region. Each state or locality may offer unique financial incentives, such as rebates or tax credits, which can significantly reduce the initial costs of solar installation. Once homeowners are informed about these options, they should assess their energy needs and property suitability for solar panels. Consulting with a certified solar installer can provide insights into system sizing and potential energy production. Additionally, homeowners should gather necessary documentation, such as tax information and utility bills, to streamline the application process for incentives. By taking these initial steps, homeowners can effectively position themselves to benefit from solar incentives while making informed decisions about their investment in renewable energy.