Whale activity has intensified around SEI, with large spot and futures orders placed near key price supports driving the initial rebound momentum. Technical indicators, including the Relative Strength Index (RSI) nearing 69 and a bullish Moving Average Convergence Divergence (MACD) crossover, confirm sustained buying pressure. Additionally, Binance’s integration as a validator for the SEI blockchain, as reported by blockchain analytics firm CryptoQuant, has boosted on-chain volume by an average of 0.11% per large order, signaling growing institutional interest.

### What Is Driving the Recent SEI Price Rally?

The SEI price rally of approximately 19% aligns with a broader altcoin market upswing, primarily propelled by increased whale accumulation and strategic partnerships. Large investors placed substantial orders near the $0.30 level in both spot and futures markets. Binance’s announcement to operate as a validator for the SEI blockchain further amplified the project’s credibility and network expansion.

This combination of on-chain activity and institutional involvement has elevated SEI to become one of the top 10 altcoin gainers in the last 24 hours.

### How Are Technical Indicators Supporting SEI’s Bullish Momentum?

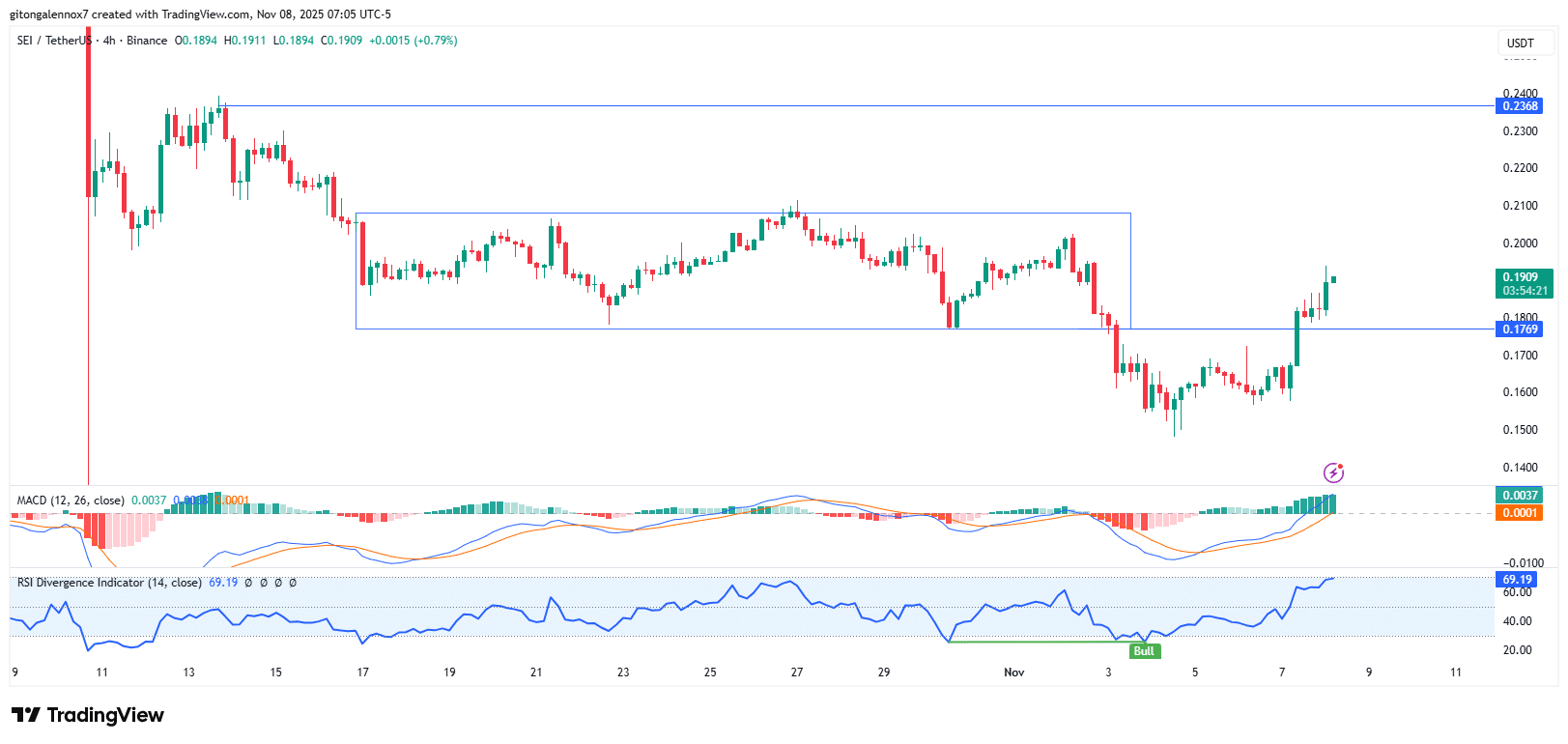

SEI’s price action recently broke out from a multi-week sideways consolidation that persisted since mid-October. The token initially tested $0.15 as a potential floor before experiencing a sharp rebound.

The RSI climbed to 69.19, approaching overbought territory but still indicating strong buyer control without immediate reversal risk, according to TradingView data. Meanwhile, the MACD showed a clear positive crossover, underscoring sustained momentum that could lead to retests of higher resistance levels.

In the near term, the $0.21 resistance zone remains critical. A decisive breakout above this level could push SEI toward the $0.23 mark—a level that would shift the broader market structure to bullish. However, until $0.23 is securely reclaimed, the overall trend remains cautiously bearish, as divergences between volume and price may prompt minor pullbacks.

### Whale Transactions Play a Pivotal Role

Large-scale whale transactions have been central to igniting this rally. In the derivatives market, significant positions emerged immediately after SEI dipped below $0.30, reflecting optimism among deep-pocketed traders amid heightened volatility. Spot market accumulation also intensified around $0.40, with average order sizes increasing by about 0.11%, based on CryptoQuant insights.

Retail investor engagement, by contrast, remained subdued. Whales have spearheaded the recovery from mid-October lows while smaller participants observed from the sidelines—a pattern commonly seen in early-stage rebounds within the cryptocurrency sector.

### Surge in Institutional-Level Buying

Institutional-level buying dominated recent SEI activity, with whale orders expanding across spot and futures platforms. This surge in large transactions highlights growing confidence in SEI’s fundamentals, especially as the token navigates its post-consolidation phases.

This bullish tilt in trading activity has persisted since late September, despite prices consolidating lower—a classic divergence that often precedes upward reversals in cryptocurrency markets.

### Binance Validator Integration and Network Upgrades

Binance’s commitment to operate as a validator supports SEI’s GIGA Speed upgrade, aimed at improving transaction efficiency and security. Blockchain experts, including those cited in recent industry reports from sources like CoinDesk, highlight such partnerships as critical for altcoins seeking long-term scalability and adoption within decentralized finance ecosystems.

As SEI continues integrating with major platforms, metrics like total value locked (TVL) and daily active users have shown incremental gains, according to data aggregated from platforms such as Dune Analytics. This positions the project favorably amid broader market recoveries, though sustained growth hinges on overcoming bearish structures above $0.23.

—

### Frequently Asked Questions

**What factors contributed to SEI’s 19% price increase in the last 24 hours?**

SEI’s 19% rally was driven by heightened whale accumulation around $0.30 and Binance’s validator integration, which strengthened blockchain credibility. On-chain metrics from CryptoQuant revealed a 0.11% uptick in average large order sizes, while technical indicators like the RSI at 69.19 supported momentum without signaling overbought exhaustion.

**Is SEI’s current rally sustainable based on volume trends?**

Yes, the rally appears sustainable due to dominant buyer volume in both spot and futures markets. The cumulative volume delta (CVD) has diverged positively since September, a pattern often signaling trend reversals. However, a pause near the $0.21 resistance level could occur before SEI aims for $0.23.

—

### Key Takeaways

– **Whale accumulation drives recovery:** Large orders near $0.30 in spot and futures markets fueled the 19% rebound, reflecting institutional confidence post-dip.

– **Technical signals align bullishly:** RSI at 69.19 and a MACD crossover signify strong momentum, though watch for potential corrections if $0.21 resistance holds firm.

—

### Conclusion

SEI’s recent 19% price rally is underpinned by significant whale buying and key institutional developments, notably Binance’s validator integration. Technical indicators support continued bullish momentum, but caution remains warranted until resistance zones are decisively broken. As SEI strengthens its network and on-chain metrics improve, the altcoin is well-positioned for further gains—provided it navigates critical resistance and maintains healthy volume trends.

https://bitcoinethereumnews.com/tech/sei-surges-19-amid-whale-accumulation-and-binance-validator-role-may-retest-0-21/